During Q2 2025, the open banking ecosystem continued to consolidate across both the UK and the EEA. The total number of registered Third Party Providers (TPPs) now stands at 546, a decrease of five from the end of the previous quarter. (This decline is smaller than the drop of 17 we reported in our Q1 2025 Tracker.)

This total comprises 353 TPPs in the EEA and 193 in the UK. The downward trend in EEA-regulated TPPs reflects the ongoing consolidation and maturation of the open banking market in the region. This quarter saw a net loss of three TPPs in the EEA and two in the UK, resulting in an overall decline of five. There were 11 permission changes this quarter – a decrease compared to the 31 changes reported in Q1. While fewer in number, these changes continue to indicate movement within the ecosystem and highlight the importance of ongoing monitoring.

As expected, the majority of these permission changes occurred in the EEA (seven), with the UK accounting for the remaining four. This further reinforces the view that the market is entering a more mature and stable phase. Despite the lower volume of change compared to previous quarters, it remains essential for organisations to have the appropriate tools in place to conduct due diligence on third parties accessing account data and funds, thereby ensuring the protection of end-users.

Q2 2025 Highlights (EEA)

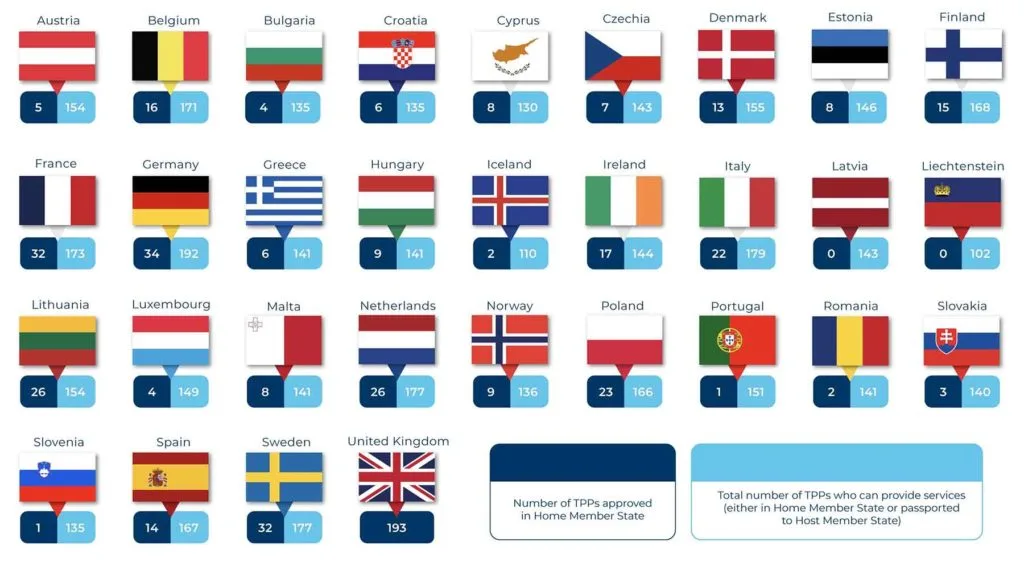

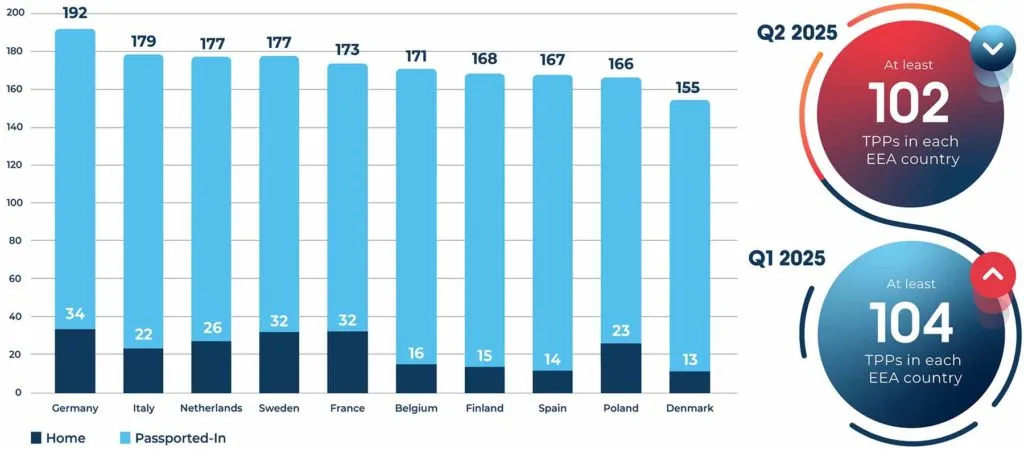

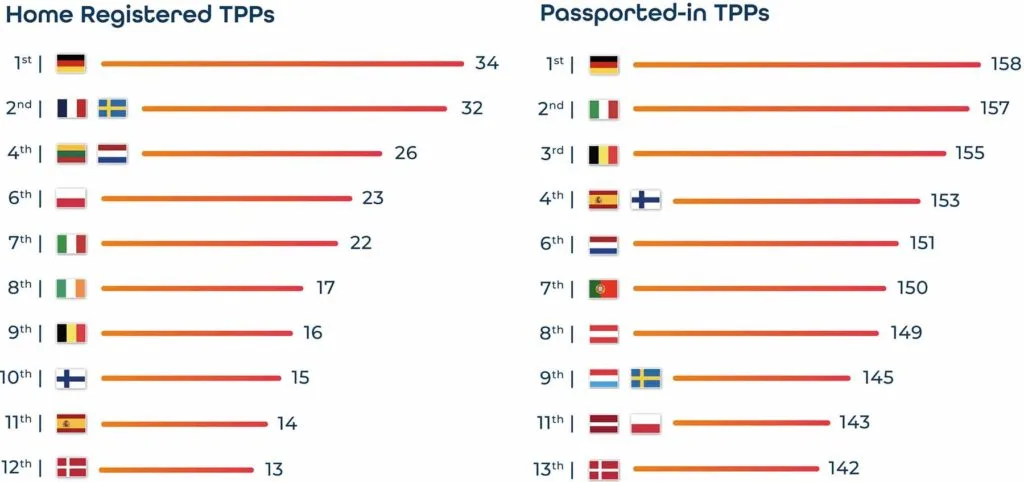

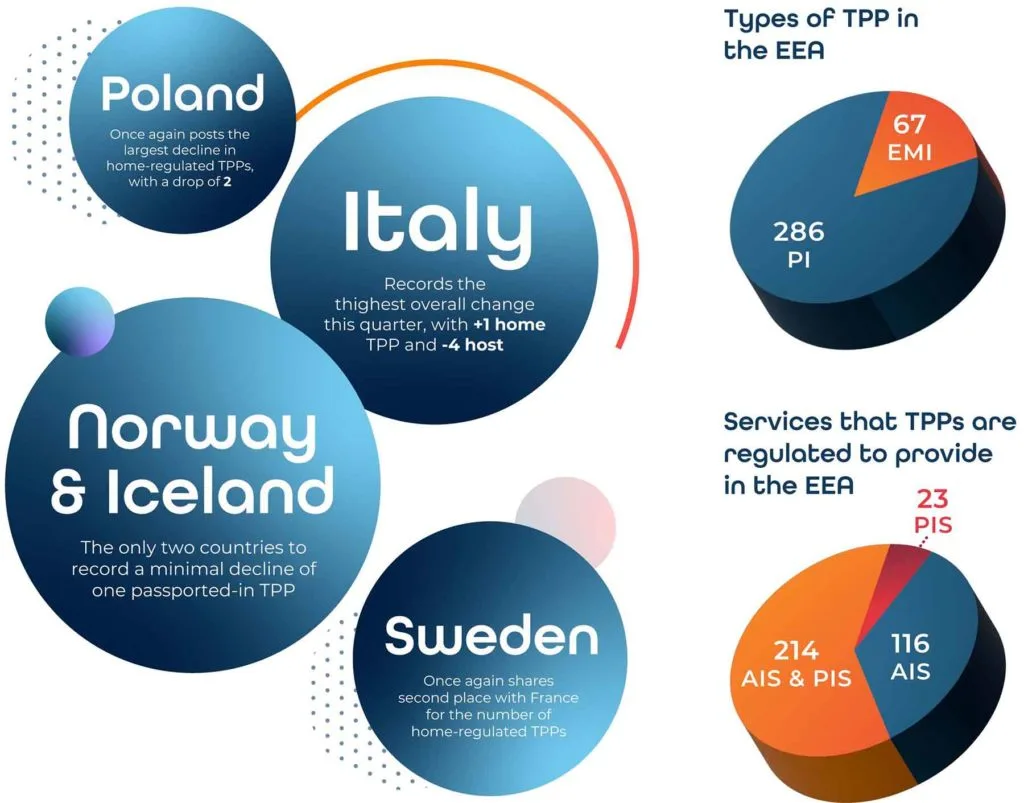

Germany continues to have the highest number of home-regulated TPPs (34), with no changes this quarter. France and Sweden follow closely, each with 32 home-regulated TPPs.

Germany also leads in the number of passported-in TPPs, although the figure fell by four to 158. Italy experienced the same reduction, maintaining its position just behind Germany with 157 passported-in TPPs.

Regulatory approvals were granted to two TPPs across the EEA this quarter: Sweden (1) and Italy (1).

Five TPPs lost open banking permissions across four EEA countries: Czechia (1), Denmark (1), Lithuania (1), Poland (2).

Latvia and Liechtenstein remain the only EEA countries without any home-regulated TPPs. However, both saw smaller declines in passporting activity than other markets, with reductions of 3 and 2, respectively.

Average passporting reductions per EEA country mirrored last quarter, at 3.

All EEA countries continue to have at least 102 TPPs approved to provide open banking services. This represents a decline from the average of 108 reported six months ago in December 2024.

Increase in TPPs Passporting Services

Top EEA markets by total number of TPPs

TPPs (57.5%) in the EEA passport their open banking

services outside their domestic market

Average total number of TPPs per EEA country

On average, 91% of TPPs in each EEA market are regulated by an NCA from another country

Of EEA countries have over 150 authorised open banking TPPs

Looking Deeper: Market Movement Persists

Q2 2025 saw a reduction in regulatory permission changes across the EEA and UK. While it’s tempting to interpret this as a sign that the market has stabilised, the reality is likely more nuanced. Business closures, strategic exits and structural changes, though fewer this quarter, are still occurring. The fact that these changes continue across multiple markets suggests the ecosystem is still adjusting, albeit at a slower and more selective pace.

At the same time, the market is anticipating the outcome of EU trilogue discussions on PSD3, the Payment Services Regulation (PSR) and the Financial Data Access (FiDA) Regulation. Once published in the Official Journal of the European Union (OJEU), these new Directives/Regulations are expected to significantly expand the open ecosystem, bringing in more financial institutions and third-party service providers.

Although this may have been a quieter quarter, the ongoing need for real-time monitoring and due diligence remains unchanged. As the regulatory landscape evolves, new market segments and players will emerge – introducing greater complexity for data providers trying to identify who is accessing their ‘open’ interfaces. The regulatory status of TPPs can still change at any time and organisations must stay vigilant to safeguard customer data and maintain trust within the ecosystem.

The top countries by TPP (EEA)

Country Spotlight

Reflections from Our CEO

Although we’ve seen a slowdown in regulatory permission changes this quarter, the underlying risk landscape remains unchanged. Two-thirds of EEA-regulated TPPs still have the ability to initiate payments on behalf of account holders and 58% continue to operate across borders. These figures have held steady, reinforcing that many TPPs are actively pursuing broad service capabilities and wider geographic reach.

The risks of cross-border operations remain high. When dealing with a TPP regulated by a competent authority in another country, organisations must go beyond verifying the entity’s identity and regulatory status - they must also confirm that the provider is authorised to deliver services into the market where the transaction is taking place. That’s why ongoing due diligence and real-time regulatory checks are essential to maintaining safe and trusted open ecosystems.Mike Woods, CEO Konsentus