Knowledge Hub

Our experts share their wealth of knowledge so you are informed on the latest Open Banking and Open Finance issues and opportunities. Our articles, whitepapers, and reports equip you with the knowledge you need to tackle any challenges you encounter as you participate in open data environments.

Use the below filtering section by clicking on the category of the content you are looking for.

In September 2021, former Minister of Finance, Rodrigo Cerda, presented a draft of the ‘Fintech Law’ to Congress. Earlier this month the CMF issued the regulation that would govern the Open Finance System (OFS) in Chile. We take a look at what it's taken to get to this point and how to make a success of open finance in Chile.

How has the market responded to our guiding principles for open finance in Europe?

Vildan Ali, Data Analyst Kosentus, talks with VP, Head of Marketing, Nicky Valind about the data we collect at Konsentus and how it enables a safe and secure open banking ecosystem.

Finologee is a fast-growing digital platform operator of robust, ready-made, and compliant systems and APIs for open finance, digital onboarding, KYC lifecycle management, account management, telecom routing, and micropayments.

Paul Love Twelves talks with our VP Head of Marketing, Nicky Valind, about the conversations he's having with Konsentus clients to help them prepare for the transition to open finance.

Brendan Jones talks to FinMag.fr about Konsentus' open banking technology and advisory services dedicated to facilitating the adoption of safe and secure open banking and open finance around the world.

Join us at the FDX Spring Global Summit 2024, one of the most prominent events for the financial ecosystem in 2024.

In celebration of International Women’s Day 2024, Lauren Jones, our SVP Global Advisory, caught up with Shruti Awasthi, Global Open Banking & Innovation Leader.

Featured Resources

Konsentus Open Banking Trackers

Monitor the development and implementation of open banking and Open Finance across the globe.

Q4 2022 Konsentus Third Party Provider Open Banking Tracker

The number of TPPs that gained regulatory approval in the EEA in Q4 2022 mirrored the preceding three months.

Q3 2022 Konsentus Third Party Provider Open Banking Tracker

Over the last three months, there has been a slowdown in newly regulated fintech TPPs. In the EEA,

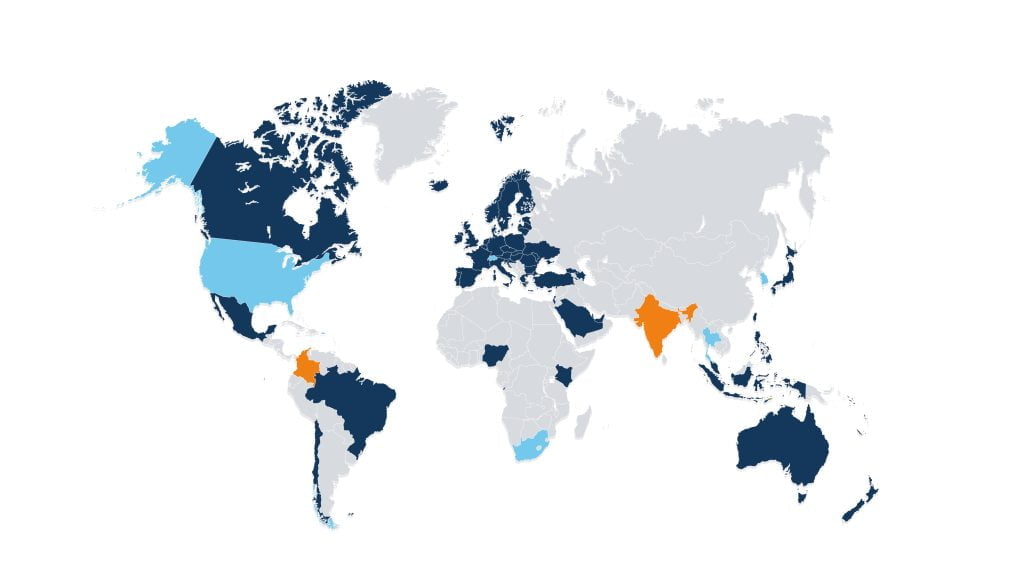

The World of Open Banking Map, Q3 2022

Open Banking and Open Finance are making their way around the globe, with many countries looking at how financial data can be shared and managed via open APIs. Follow the journey with us through our Open Banking world map.

Q2 2022 Konsentus Third Party Provider Open Banking Tracker

The Konsentus Q2 2022 Open Banking TPP tracker sees the total number of fintech third party providers (TPPs) in the EEA now stand at 338, marking a much faster rise than the last few quarters.

Q2 2022 Mastercard Tracker (in Partnership with Konsentus)

Mastercard explores the rise of open banking with their Q2 2022 Open Banking Tracker, produced by Open Banking

Talk with Our Team Today

Join us on the Journey

Protect your customers transacting in open ecosystems.