As open banking in the EEA enters its seventh year, the total number of authorised Third Party Providers (TPPs) has increased for the first time since Q3 2024. The overall figure now stands at 554, up 17* from the end of Q3, marking the first quarterly rise in over a year.

This total comprises 361 TPPs in the EEA and 193 in the UK. The growth was driven primarily by the EEA, which recorded a net increase of 15, while the UK saw a more modest rise of two.

There were 33 permission changes during Q4, returning to levels comparable with the 31 changes recorded at the end of Q1. As in previous quarters, the majority occurred in the EEA (27), with the remaining six in the UK.

Q4 2025 Highlights (EEA)

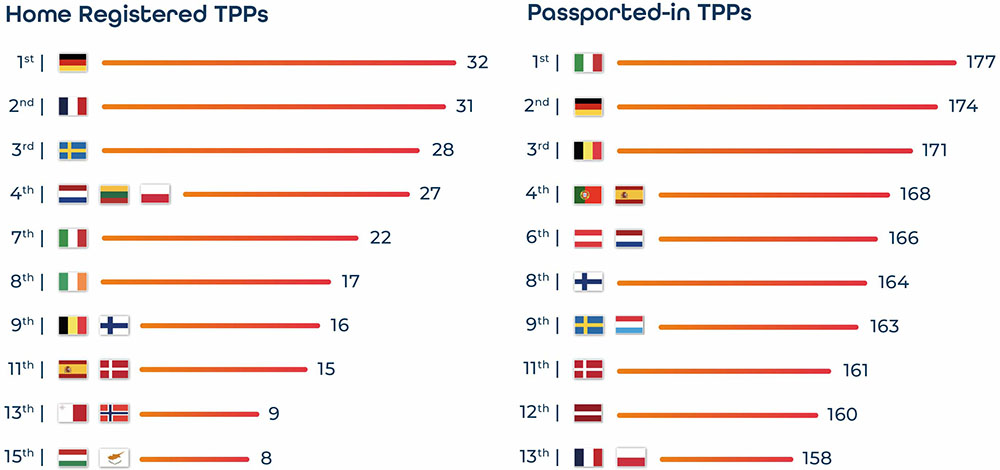

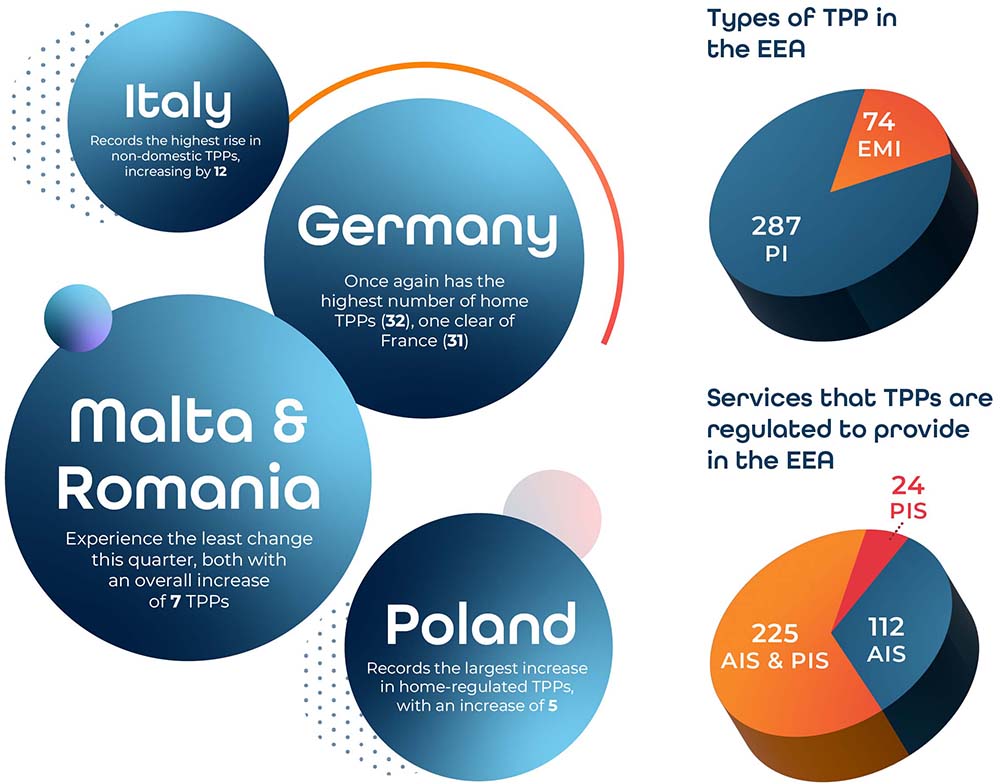

- Germany continues to have the highest number of home-regulated TPPs (32), despite one withdrawal during the quarter. France (31) and Sweden (28) follow closely behind.

- Italy leads once again in passported-in TPPs, reaching 177, an increase of twelve from the previous quarter. Germany retains second place, with its non-domestic TPPs rising by ten to 174.

- Regulatory approvals are recorded for 21** additional TPPs across the EEA this quarter: Austria (1), Bulgaria (3), Cyprus (2), Denmark (2), Estonia (1), Greece (1), Lithuania (1), Luxembourg (1), Malta (1), Norway (2), Poland (5) and Spain (1).

- Conversely, 6 TPPs lost open banking permissions across six EEA countries: Cyprus (1), Germany (1), Hungary (1), Norway (2) and Sweden (1).

- Latvia and Liechtenstein remain the only EEA markets without any home-regulated TPPs. However, both continue to attract cross-border activity, with their non-domestic TPP numbers each increasing by eight.

- Passporting activity rose again this quarter, with each EEA market gaining an average of nine passported-in TPPs.

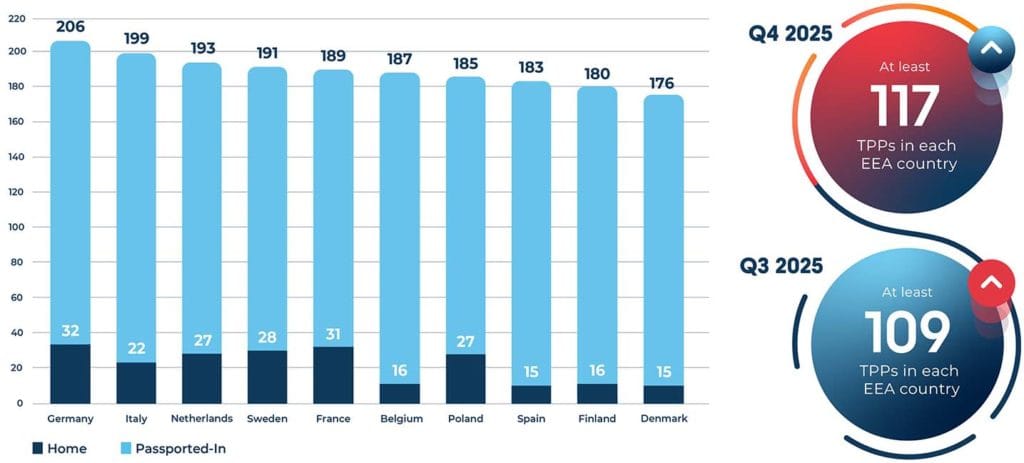

- For the first time, a market has surpassed the 200 TPP mark, with Germany reaching 206 total authorised providers. Every EEA country now has more than 117 TPPs authorised to provide open banking services.

Increase in TPPs Passporting Services

Top EEA markets by total number of TPPs

TPPs (61.2%) in the EEA passport their open banking services outside their domestic market

Average total number of TPPs per EEA country

On average, 93% of TPPs in each EEA market are regulated by an NCA from another country

of EEA countries have over 150 authorised open banking TPPs

EEA Market Dynamics: Growing Scale and Sustained Cross-Border Reach

Q4 2025 reinforces the continued expansion of Europe’s open banking ecosystem. While home-regulated TPP numbers remain broadly stable across many markets, overall coverage continues to deepen as cross-border passporting sustains high levels of activity.

Germany now exceeds 200 authorised TPPs (206), with Italy close behind at 199. Belgium, France, the Netherlands, Poland and Sweden have each reached 185 or more.

More broadly, the majority of EEA countries now host more than 150 authorised TPPs, highlighting consistent market penetration across the region. Passported-in providers significantly outnumber home-regulated entities, underlining the central role of cross-border access in shaping the competitive landscape.

Overall, Q4 reflects a mature and increasingly interconnected ecosystem, where scale continues to build across markets and cross-border reach remains a defining feature of European open banking.

The top countries by TPP (EEA)

Country Spotlight

Reflections from Our CEO

"Q4 demonstrates that Europe’s open banking ecosystem is not slowing; it is scaling. While domestic authorisation numbers remain relatively stable in many markets, overall reach continues to expand, with several countries now approaching or exceeding 200 authorised TPPs.

Passporting remains the defining feature of this landscape. In most EEA jurisdictions, the majority of providers can operate cross-border, meaning the impact of regulatory changes is rarely confined to a single market. What may appear incremental in one country can have implications across the region.

As the industry prepares for the next phase of data-sharing under FiDA, the ecosystem will only become more complex. More data categories, broader permissions and deeper cross-border integration will require organisations to have absolute clarity over who is accessing data and under what authority.

In this environment, continuous monitoring and real-time permission verification are no longer optional safeguards; they are fundamental to maintaining trust in an increasingly interconnected financial system."

Mike Woods, CEO Konsentus

*The figure of 17 includes some TPPs that were authorised but reported as unauthorised on the registers at the end of Q3 2025.

**This figure includes some TPPs that were authorised but reported as unauthorised on the registers at the end of Q3 2025.