Over the second half of 2023 we saw a slight increase in momentum compared with the first half of the year. In the UK, newly approved TPPs are some of the largest mainland European aggregators setting up legal entities following the end of the temporary permissions regime.

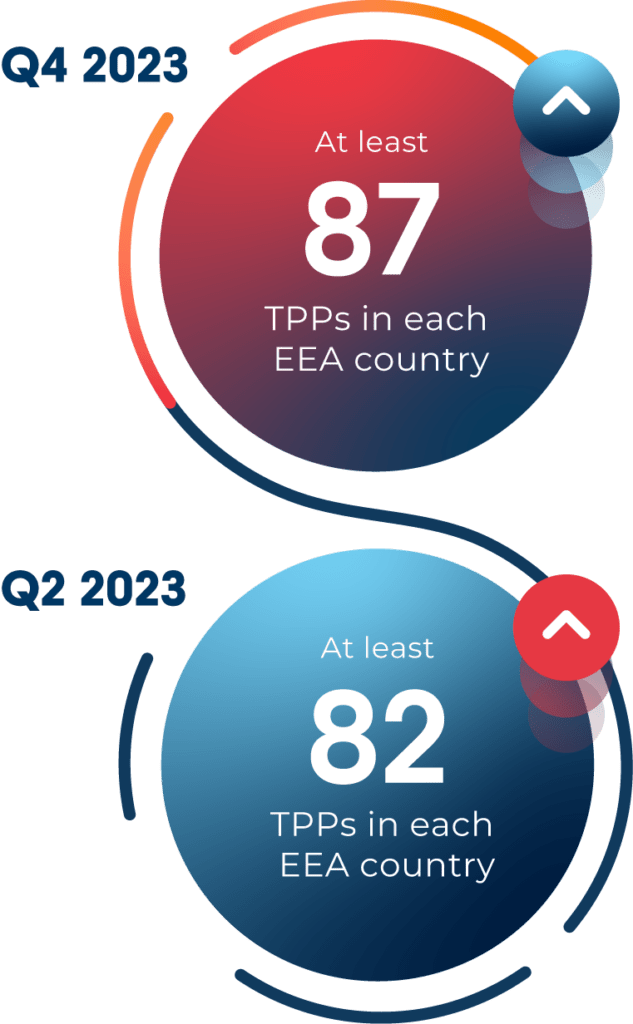

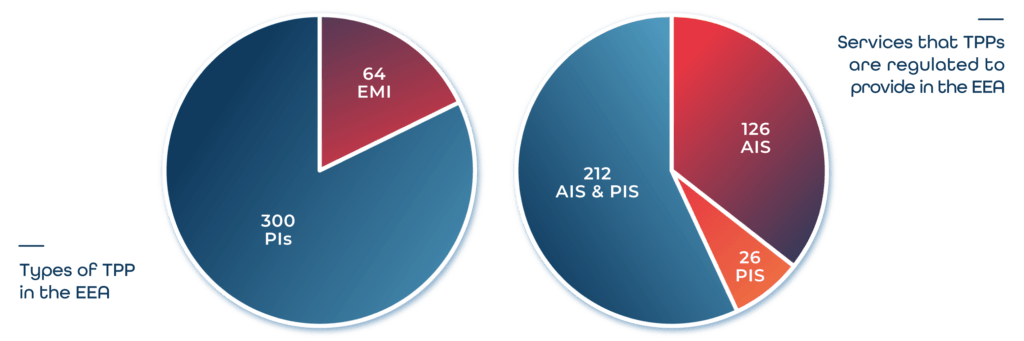

In the EEA, 18 TPPs gained regulatory permissions whilst 9 had their permissions removed. This resulted in a net increase of 9, taking the EEA’s total to 364.

In the UK, 10 TPPs gained regulatory approval and 4 TPPs had their permissions removed from the register, giving a net increase of 6, taking the UK and Gibraltar’s total to 208.

The overall total across the UK and EEA now stands at 572, a 3% increase from six months ago, a marked contrast from the flatlined numbers experienced since September 2022.

As with Konsentus’ previous reports, looking at net growth alone only tells half the story. There were a total of 41 regulatory permission changes over the second half of 2023, a similar figure to the 45 recorded in the first half of the year. This does not include all the additional passporting changes which makes checking the national registers for every transaction so important.

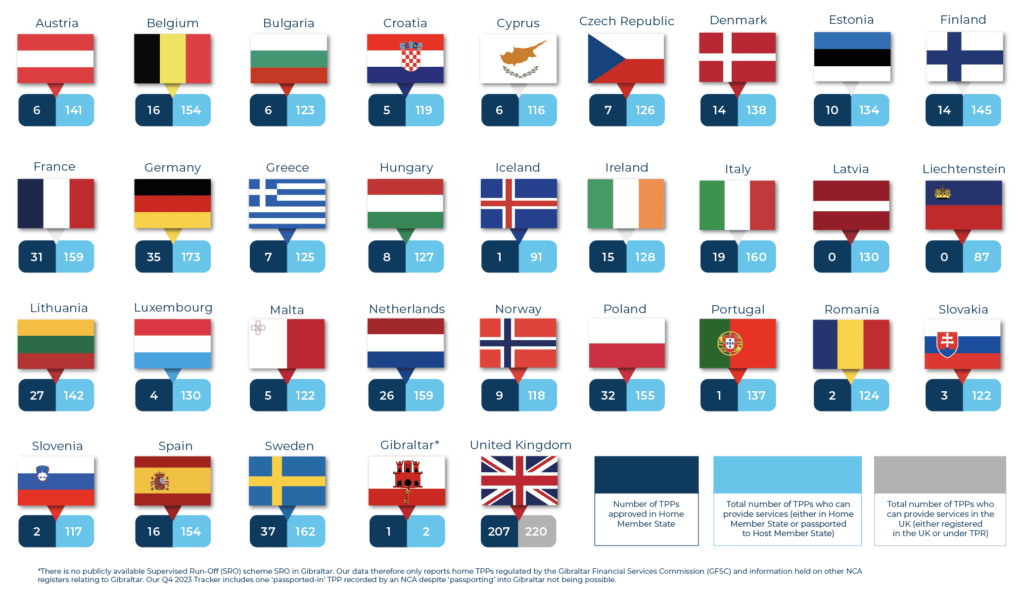

Q4 Highlights (EEA)

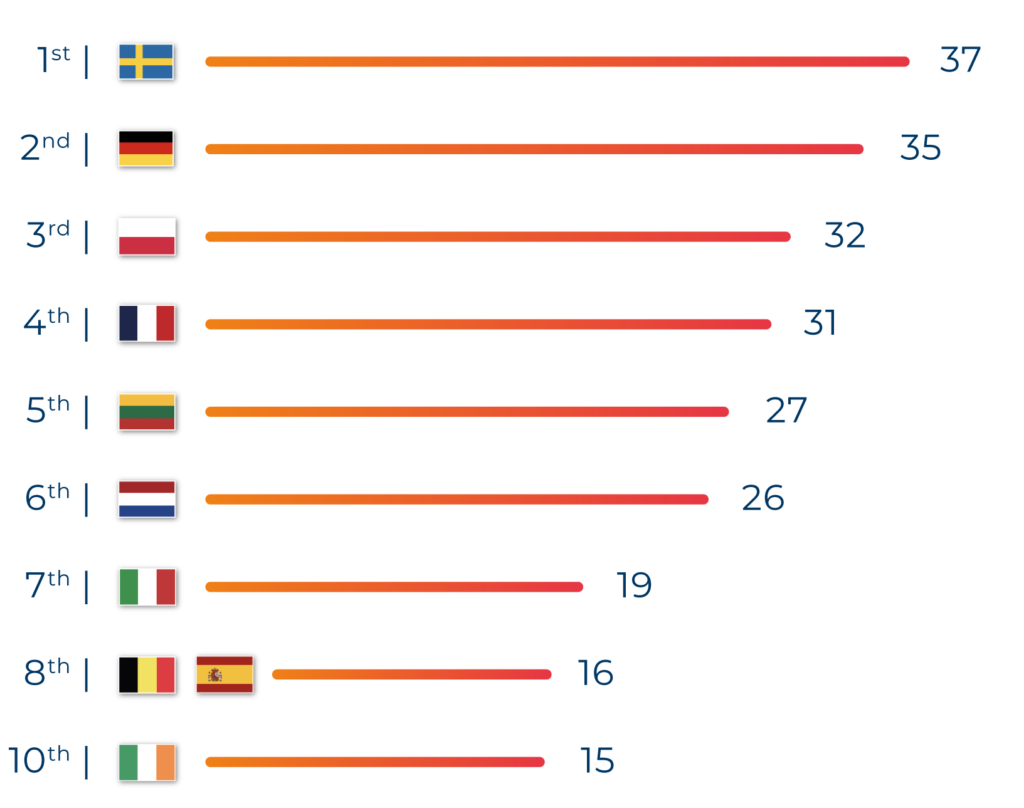

- Sweden still has the highest number of home-regulated TPPs, at 37, a figure first reached in December 2021

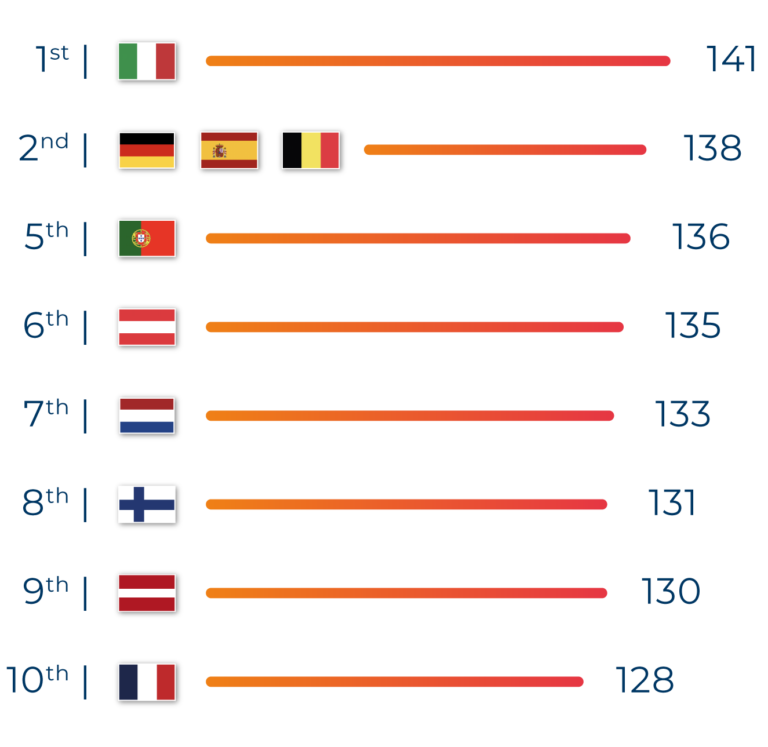

- Italy has the highest number of passported-in TPPs (141), followed by Belgium, Germany and Spain, with 138 respectively

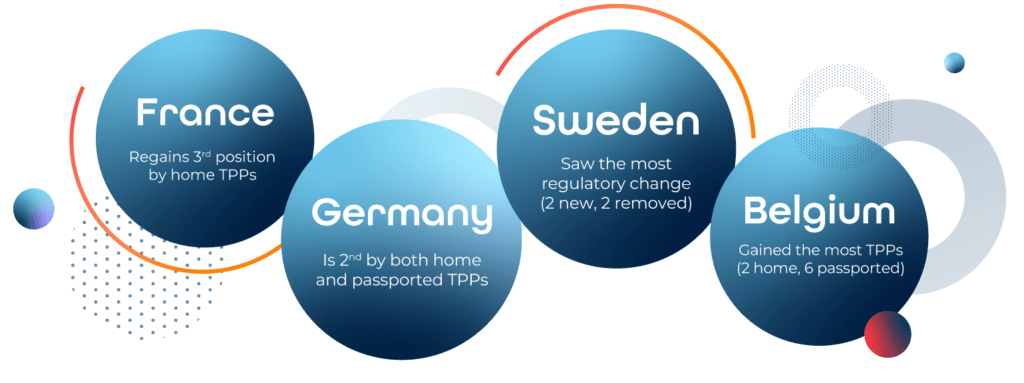

- TPPs from 13 different EEA markets gained regulatory approval during the second half of 2023: Belgium (2), Estonia (1), France (1), Greece (1), Iceland (1), Ireland (1), Italy (1), Lithuania (2), Malta (1), Poland (2), Portugal (1), Spain (2), Sweden (2)

- TPPs from 8 different EEA countries had their regulatory permissions removed: Cyprus (1), France (1), Germany (1), Italy (1), Netherlands (1), Slovakia (1), Slovenia (1),

Sweden (2) - Latvia and Liechtenstein remain the only two markets with no home TPPs now that Iceland once again has a regulated TPP

Between June and December 2023, each country gained on average 5 additional passported TPPs, a decline on the 10 reported over the same period the previous year

Year on Year Rise in Passported-In TPPs

(Average per EEA Country)

(average no. passported-in TPPs)

Dec 2023

Jun 2023

Dec 2022

Jun 2022

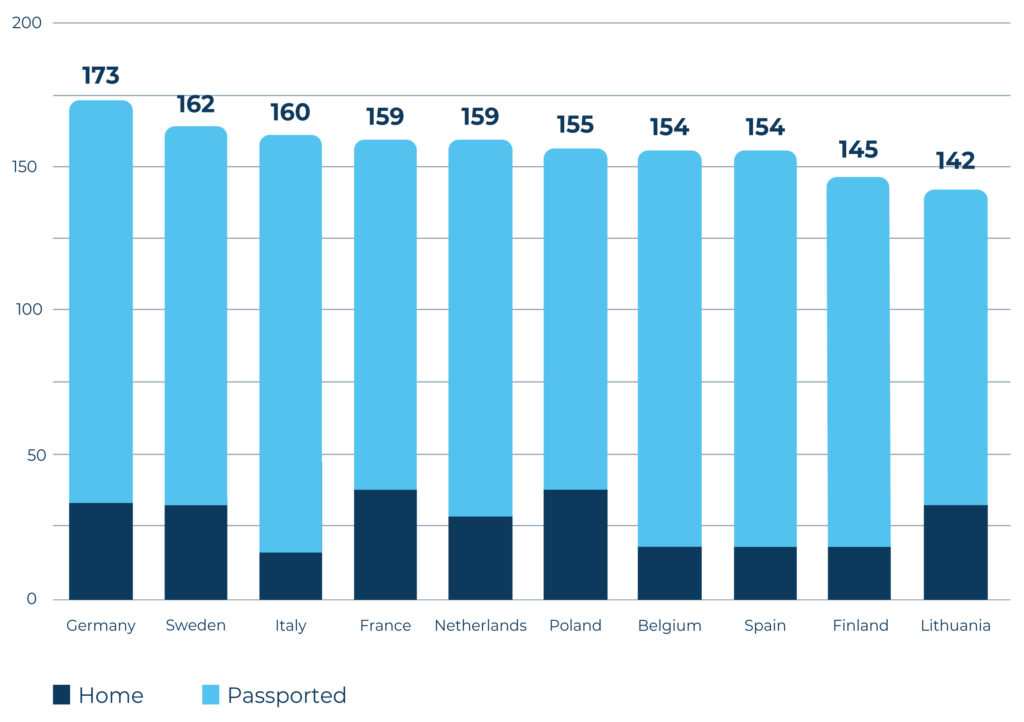

Top 10 EEA markets by total number of TPPs

TPPs passport their domestic open banking services to other countries within the EEA

Average total number of TPPs per EEA country

average net increase in passported-in TPPs per EEA country

(Jun 23 – Dec 23)

average net increase in home regulated TPPs per EEA country

(Jun 23 – Dec 23)

Open banking in Europe is entering its sixth year and the market is maturing. Whilst we’re seeing little movement in the leaderboard (both by home-regulated TPPs and by passported-in TPPs), the number of TPPs continues to grow.

Nearly half of all EEA TPPs passport their open banking services to countries outside their domestic market. Checking a TPP’s individual passporting permissions is extremely important as they can vary widely and can also be subject to change.

There are now 8 countries joining the UK in having over 150 total TPPs providing consumers and businesses with open banking services. This is a marked increase from a year ago when only Germany and Sweden enjoyed that status.

The top countries by TPP (EEA)

Home Registered TPPs

Passported-in TPPs

Country Spotlight

Reflections from Our CEO

Net growth over the second half of 2023 increased slightly from the earlier half of the year and there continues to be additional underlying change at a market level.

What’s interesting to note is that the number of TPPs who can initiate payments on a customer’s behalf is slowly rising. The figure now stands at 65% of all EEA TPPs, an uplift of 2% from the end of 2022. With transaction volumes on the rise, (in the UK alone, daily volumes increased by 13% between June and December 2023), this is obviously a risk factor for banks, particularly when passporting is added into the mix.

Banks should now be preparing for the next big wave of innovation with planning well underway for the addition of new use cases such as Variable Recurring Payments (VRPs) and the transition to PSD3 and FiDA.

Mike Woods, CEO Konsentus