As open banking in the EEA reaches its sixth anniversary, the market continues to evolve, showing both consolidation and stabilisation across regions. The total number of authorised Third Party Providers (TPPs) now stands at 537, a net decline of nine since the end of Q2, almost twice the reduction seen in the previous quarter.

This total comprises 346 TPPs in the EEA and 191 in the UK. The continued downward trend in EEA-regulated TPPs reflects the ongoing consolidation and change in the open banking market in the region, following a trajectory similar to that of the UK, a slightly more mature market. This quarter saw a net loss of 7 TPPs in the EEA and 2 in the UK.

There were 19 permission changes during Q3, an increase from 11 in Q2 but well below the 31 recorded at the end of Q1. The majority occurred in the EEA (13), with the remaining six in the UK, continuing a familiar quarterly pattern.

With FiDA on the horizon and open finance set to expand access to new data sets, it is vital for financial institutions to ensure their systems, processes and partnerships are ready for the next phase of open data innovation.

Q3 2025 Highlights (EEA)

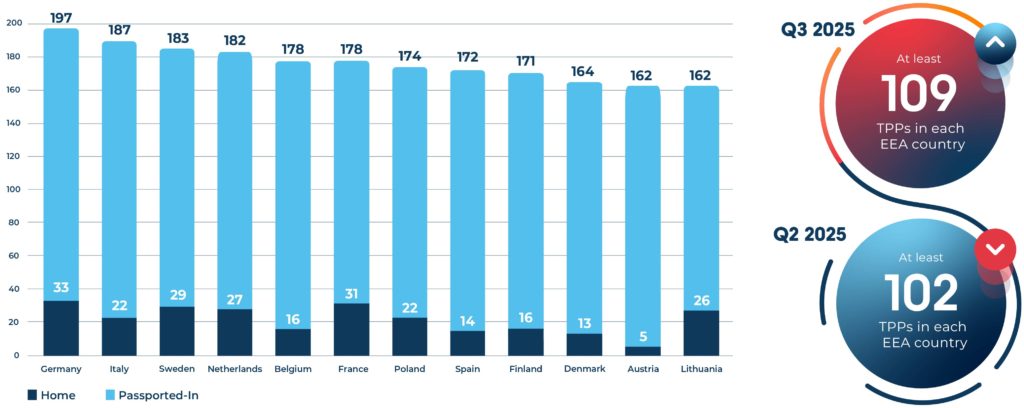

- Germany continues to have the highest number of home-regulated TPPs (33), despite one withdrawal during the quarter. France and Sweden follow closely with 31 and 29, respectively.

- Italy leads once again in passported-in TPPs, reaching 165, an increase of eight from the previous quarter. Germany retains second place, with its non-domestic TPPs rising by six to 164.

- Regulatory approvals were granted to three new TPPs across the EEA this quarter, in Bulgaria (1), Finland (1) and the Netherlands (1).

- Conversely, ten TPPs lost open banking permissions across seven EEA countries: Bulgaria (1), Cyprus (1), Estonia (2), France (1), Germany (1), Poland (1) and Sweden (3).

- Latvia and Liechtenstein remain the only EEA markets without any home-regulated TPPs. However, both continue to attract significant cross-border activity, with increases of nine and seven passported-in TPPs, respectively.

- After two consecutive quarters of decline, passporting activity rebounded, with each EEA market gaining an average of eight passported-in TPPs.

- All EEA countries now have a minimum total of 109 authorised TPPs, marking the first time the region has exceeded the 108 level reached at the end of last year. This upward shift signals a recovery following two quarters of contraction.

Increase in TPPs Passporting Services

Top EEA markets by total number of TPPs

TPPs (60.4%) ) in the EEA passport their open banking services outside their domestic market

Average total number of TPPs per EEA country

On average, 93% of TPPs in each EEA market are regulated by an NCA from another country

of EEA countries now exceed 150 authorised TPPs, a sharp rise from 43% at the end of Q2

EEA Market Dynamics: Broader Coverage Despite Fewer Players

Q3 2025 presents a more active picture than last quarter. While the total number of authorised TPPs declined slightly, the data points to a market that is deepening rather than contracting.

Across the EEA, three new TPPs were authorised and ten withdrawn, resulting in a net decrease of seven. Yet, passporting activity continues to expand. Of the 346 EEA-authorised TPPs, over 60% (209) can now operate beyond their home jurisdiction, highlighting stronger cross-border engagement and broader market reach.

Almost two-thirds of European markets now have more than 150 regulated TPPs, offering consumers and businesses greater choice and access.

Overall, Q3 reflects a maturing and increasingly interconnected ecosystem, where fewer TPPs are operating at greater scale; a sign of consolidation, but also of growing efficiency and resilience within open banking.

The top countries by TPP (EEA)

Country Spotlight

Reflections from Our CEO

Although the overall number of regulated TPPs has declined slightly this quarter, the ecosystem is becoming more interconnected, not less.

Over 60% of EEA-regulated TPPs are authorised to passport their services across borders, meaning that what might look like a small number of changes on paper can in reality have far-reaching effects.

With FiDA on the horizon, it’s clear that open finance and a much broader data-sharing framework are inevitable; therefore, the scale and complexity of this ecosystem will increase dramatically. More data types, more permissions and more cross-border activity will make understanding who’s accessing data, and on what basis, even more critical.

As the ecosystem grows, real-time due diligence and permission checking won’t just be best practice, they’ll be essential to maintaining trust and security in an environment where change is constant.

Mike Woods, CEO Konsentus