Open finance extends the scope of the European Union’s Payment Services Directive 2 (PSD2), commonly referred to as open banking, to encompass the full spectrum of a consumer’s or business’s financial life, including payments, savings, investments, pensions, insurance, and digital assets.

The EU’s proposed Financial Data Access (FiDA) Regulation creates a harmonised legal and technical framework to make open finance a reality across the European Economic Area (EEA). FiDA establishes common rules for who must share what data, with whom and under which safeguards, while introducing the new role of Financial Information Service Providers (FISPs) to consume data on user consent.

By pairing standardised access rights with supervisory oversight and machine-readable authorisation, FiDA is designed to overcome PSD2’s fragmentation and deliver a competitive, cross-border data economy.

Under the FiDA regulation, consumers and SMEs gain portable access to their financial data from a far wider set of Data Holders; authorised third parties gain clear, consistent rules to build value-added services; and supervisors gain visibility into adoption, passporting and market conduct to ensure trust at an EU scale. Compared with peer regimes (UK Smart Data/Open Banking, US Dodd-Frank 1033, Australia CDR, Brazil Open Finance, India Account Aggregators, Singapore SGFinDex), FiDA aims to combine the EU’s rights-based approach with pragmatic implementation levers that have proven to drive uptake elsewhere.

Why open finance, and why now?

European consumers and businesses increasingly expect simple, secure and portable access to their financial information. A secure data-sharing layer enables:

- Competition and switching:product comparison, account portability and multi-provider experiences that push incumbents and challengers to compete on price, service and features

- Financial health and inclusion:consented aggregation enables cash-flow underwriting, bill-level insights, proactive savings and debt management that materially improve outcomes for households and SMEs

- SME productivity and access to credit:real-time sharing of account, invoice, payroll and tax data reduces the onboarding process and enables risk-based pricing for underserved firms

- Safer markets:verified participants, enforceable consent and audit trails reduce impersonation, mis-scoping and data misuse

Global experience underscores the upside. Brazil’s Central Bank led Open Finance ecosystem reports tens of millions of active data-sharing customers and hundreds of participating institutions; India’s Account Aggregator (AA) network has linked over 200 million users and billions of accounts to streamline credit access; Singapore’s SGFinDex demonstrates secure, consent-driven sharing across banks, insurers and government data.

The EU Financial Data Access (FiDA) Regulation: What it does

FiDA is the EU’s horizontal framework for open finance. In brief, it:

- Defines in-scope data and actors:It sets out categories of customer financial data to be shared and identifies Data Holders [e.g., banks, insurers, investment firms, e-money institutions, Institutions for Occupational Retirement Provision (IORPs) and Crypto Asset Service Providers (CASPs) etc.] and Financial Information Service Providers (FISPs) that access that data with user consent.

- Creates consistent rights and obligations: Data Holders must provide secure, standards-based interfaces; FISPs must be authorised and meet security and conduct standards; consumers retain GDPR-grade rights and control.

- Builds supervisory foundations:Compared with PSD2’s decentralised reporting, FiDA is designed for harmonised, machine-readable registers, stronger cross-border passporting visibility and clearer accountability, closing the KPI gap that hindered PSD2.

The vision of the FiDA regulation is to deliver a single EU rulebook that reduces integration costs, improves cross-border scalability and equips National Competent Authorities (NCAs)/European Supervisory Authorities (ESAs) with the data they need to monitor adoption and market conduct in real time.

How FiDA enables benefits for consumers and businesses

Consumers gain a holistic financial picture (i.e. banking, pensions, insurance, investments etc.) in the tools they choose; faster switching and personalised offers; safer digital journeys with verified participants and audit trails. Businesses gain streamlined onboarding, cash-flow analytics, invoice and receivables data sharing and easier access to working-capital finance. Enterprise organisations can orchestrate multi-product experiences (e.g., embedded insurance, pension dashboards and portfolio rebalancing) using consistent EU-wide access rules. These outcomes mirror results seen in markets with strong central infrastructure (e.g. the UK’s Open Banking Limited model reports millions of active users and transparent performance reporting; Brazil and India show large-scale adoption when standards and verification are clear).

FiDA approach in global context

The proposed FiDA regulation represents the most ambitious and comprehensive attempt globally to create a unified legal framework for open finance. While other jurisdictions have pioneered aspects of data sharing, such as the UK, Australia, Brazil and India, none have yet achieved the same cross-sector, cross-border scope envisioned by FiDA. Unlike fragmented or market-driven approaches elsewhere, FiDA seeks to embed open finance within a single legislative and supervisory architecture, harmonising data access rights, technical standards and regulatory oversight across 30 EEA jurisdictions. This positions Europe to move beyond open banking toward a trusted, competitive and privacy-preserving data economy, setting a global benchmark for how financial data can be shared securely at scale.

Table 1: Example Approaches to Open Finance

| Jurisdistion | Model | Scope & status | Adoptable Measuresfor Europe |

|---|---|---|---|

| UK (OBIE → Open Banking Limited; Smart Data roadmap) | Central implementation body + single API standard + live directory + KPI reporting | Open banking live; Government pushing Smart Data into energy, banking, finance, retail, transport, home-buying and telecommunications | Central standards, conformance testing and public KPIs accelerate adoption. |

| US (CFPB 1033) | Rights-based data access via rulemaking; private standards | Final rule issued Oct 2024; subsequent revisions underway in 2025 | Clarify covered data, phase-in obligations and ensure portability across providers. |

| Australia (CDR) | Cross-sector, statutory data right; staged rollout | Banking live; energy and non-bank lending expanding; active enforcement | Cross-sector consistency and regulator-backed accreditation/penalties build trust. |

| Brazil (Open Finance + Pix) | Central bank mandates; national standards; instant payments | 801 participants (institutions & cooperatives); 68m accounts; deep payments integration | Pairing data sharing with real-time payments drives usage. |

| India (Account Aggregators) | Licensed consent managers; public-digital-infrastructure rails | >2.2B financial accounts enabled (of these 112.34 million have linked their accounts); credit flow at scale | Consent orchestration + strong identity rails unlock credit for Micro, Small and Medium Enterprises (MSMEs). |

| Singapore (SGFinDex) | Government-backed, bank & agency data sharing via SingPass | Live since 2020; multi-sector aggregation | National digital identity + narrow, high-trust scope yields adoption. |

FiDA aims to blend the UK’s centralised discipline (standards, directories, KPIs) with the EU’s rights-based legal bedrock and the cross-sector ambition seen in Australia and Singapore, delivering scale across 30 EEA jurisdictions.

Design pillars for a trustworthy EU open finance ecosystem

The FiDA regulation sets the foundation (core principles) for a unified and secure open finance ecosystem across Europe. Its design balances innovation with trust, ensuring consumers, businesses and financial institutions can share and access data safely and efficiently. Built on principles of transparency, interoperability and resilience, FiDA establishes consistent rules, technical standards and oversight mechanisms across all Member States, aiming to transform fragmented national approaches into a single, integrated framework for data-driven financial services.

The FiDA core principles include:

- Consent, control and purpose limitation:GDPR-aligned consent flows, revocation and clear purposes; enforced in interfaces and contracts

- Authorisation and verification by default: Machine-readable registers for Data Holders and FISPs; live certificate checks; audit-ready event trails

- Common technical baselines:EU-wide profile(s) for APIs, data models and performance SLAs; conformance testing and public uptime/error KPIs – learning from the UK

- Supervisory visibility: Harmonised metrics on usage, passporting, failures and incidents to enable proactive enforcement and policy iteration

- Security and resilience:Alignment with DORA, eIDAS 2.0 and incident reporting to harden identity and operational controls across the ecosystem.

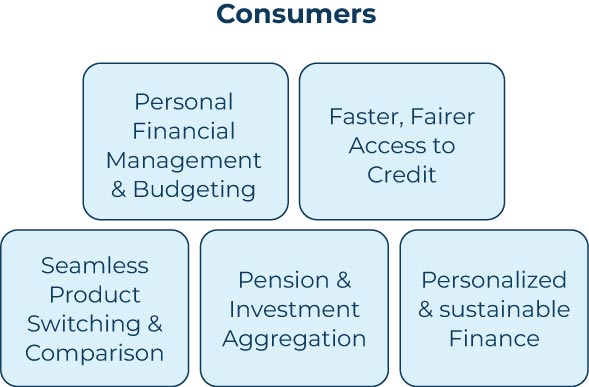

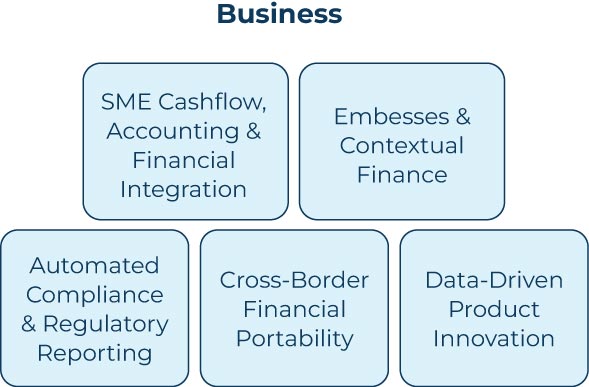

How can Consumers & Businesses benefit from FiDA

The introduction of FiDA will unlock a new wave of innovation across Europe’s financial ecosystem, significantly expanding the range of use cases that benefit both consumers and businesses. By enabling secure, consent-based access to a broader set of financial data, FiDA empowers organisations to develop more personalised, efficient and inclusive services. This seamless data sharing will drive competition, enhance financial decision-making and create tangible value for individuals, SMEs and enterprise institutions alike, marking a major step toward a fully connected open finance economy.

Example use cases include:

FiDA: Trilogues, Outstanding Issues & Timeline

The draft FiDA regulation was formally published by the European Commission on 28th June 2023 as part of its digital-finance package. Since then, the regulation has moved into the so-called “trilogue” phase, where the Commission, the European Parliament and the Council of the EU negotiate to reconcile their respective positions into a final text.

Several key issues remain under debate and they include:

- Scope and data categories: There is division over how broadly data access should extend. For example, whether occupational pension rights, enriched/derived data, or third-country entities should be covered.

- Implementation and timing: The Commission’s original draft proposed an 18-month timeframe for the establishment of Financial Data Sharing Schemes (FDSSs) and a further 6-12 months for live interfaces; however, there is now broader support for a longer and staggered roll-out with phased implementation and different data categories brought in at different times.

- Gatekeeper / big tech access: The text must resolve how so-called “gatekeepers” (large tech platforms) may or may not access data as authorised Financial Information Service Providers (FISPs) and how to safeguard market competition and data sovereignty.

- Cross-border passporting and enforcement: Ensuring that authorisations and access rights operate seamlessly across Member States and that supervisory authorities have sufficient data visibility and enforcement powers.

As to the expected timeline: while early commentary projected publication by end-2024 or early 2025, subsequent delays and the complexity of negotiations mean that agreement may not be reached before the end of 2025 and could extend into 2026.

Once the trilogue concludes and the Council and Parliament formally adopt the regulation, it will be published in the Official Journal of the European Union (OJ). The regulation then typically enters into force on the 20th day following publication, with application to follow after the transitional period defined in the text.

Given current signals, many market participants anticipate that FiDA’s provisions will begin to apply in phases from 2027 – 2030, depending on sectoral roll-out and scheme establishment.

FiDA: Europe’s Once-in-a-Decade Opportunity to Build a Coherent, Secure and Scalable Open Finance Ecosystem

FiDA gives Europe a once-in-a-decade opportunity to turn fragmented data access into a coherent, secure and scalable open finance ecosystem. By aligning rights, obligations, supervision and technical baselines; and by learning from the UK, Australia, Brazil, India, Singapore and the evolving US rulemaking, Europe can unlock competition, innovation and consumer benefit at continental scale. The prize is a Single Market where trusted data portability is routine, cross-border services are the norm and supervisors have real-time visibility to keep the system safe.

As Europe moves from vision to implementation, the hard work now shifts to understanding what FiDA will mean in practice: for data governance, technical standards, scheme participation, consent management and supervisory expectations. Much is still to be shaped, but the direction is clear, and early preparation will be essential to realise the opportunities while managing the operational and compliance impacts.

If you would like support in assessing readiness, interpreting the evolving regulations or shaping your strategy for the years ahead, our team is closely engaged in these developments and can help you plan with confidence.