Open finance extends the scope of the European Union’s Payment Services Directive 2 (PSD2), commonly referred to as open banking, to encompass the full spectrum of a consumer’s or business’s financial life, including payments, savings, investments, pensions, insurance and digital assets.

The EU’s proposed Financial Data Access (FiDA) Regulation creates a harmonised legal and technical framework to make open finance a reality across the European Economic Area (EEA). FiDA establishes common rules for who must share what data, with whom and under which safeguards, while introducing the new role of Financial Information Service Providers (FISPs) to consume data on user consent.

By pairing standardised access rights with supervisory oversight and machine-readable authorisation, FiDA is designed to overcome PSD2’s fragmentation and deliver a competitive, cross-border data economy.

Under the FiDA regulation, consumers and SMEs gain portable access to their financial data from a broad range of data holders; authorised third parties gain clear, consistent rules to build value-added services; and supervisors gain visibility into adoption, passporting and market conduct to ensure trust at an EU scale. Compared with peer regimes (UK Smart Data/Open Banking, US Dodd-Frank 1033, Australia CDR, Brazil Open Finance, India Account Aggregators, Singapore SGFinDex), FiDA aims to combine the EU’s rights-based approach with pragmatic implementation levers that have proven to drive uptake elsewhere.

Why open finance and why now?

European consumers and businesses increasingly expect simple, secure and portable access to their financial information. A secure data-sharing layer enables:

- Competition and switching:product comparison, account portability and multi-provider experiences, encourages incumbents and challengers to compete on price, service and features

- Financial health and inclusion:consented aggregation enables cash-flow underwriting, bill-level insights, proactive savings and debt management that materially improve outcomes for households and SMEs

- SME productivity and access to credit:real-time sharing of account, invoice, payroll and tax data reduces the onboarding process and enables risk-based pricing for underserved organisations

- Safer markets:verified participants, enforceable consent and audit trails reduces impersonation, mis-scoping and data misuse

Global best practice reinforces the benefits. Brazil’s Central Bank led Open Finance ecosystem reports tens of millions of active data-sharing customers and hundreds of participating institutions; India’s Account Aggregator (AA) network has linked over 200 million users and billions of accounts to streamline credit access; Singapore’s SGFinDex demonstrates secure, consent-driven sharing across banks, insurers and government data.

The EU Financial Data Access (FiDA) Regulation: What it does

FiDA is the EU’s horizontal framework for open finance. In brief, it:

- Defines in-scope data and actors:It sets out categories of customer financial data to be shared and identifies data holders [e.g., banks, insurers, investment firms, e-money institutions, institutions for occupational retirement provision (IORPs) and crypto asset service providers (CASPs) etc.] and financial information service providers (FISPs) that can access that data with user consent.

- Creates consistent rights and obligations: Data holders must provide secure, standards-based interfaces; FISPs must be authorised and meet security and conduct standards; consumers retain GDPR-grade rights and control.

- Builds supervisory foundations:Compared with PSD2’s decentralised reporting, FiDA is designed for harmonised, machine-readable registers, stronger cross-border passporting visibility and clearer accountability, closing the KPI gap that hindered PSD2.

The vision of the FiDA regulation is to deliver a single EU rulebook that reduces integration costs, improves cross-border scalability and equips National Competent Authorities (NCAs)/European Supervisory Authorities (ESAs) with the data they need to monitor adoption and market conduct in real time.

How FiDA enables benefits for consumers and businesses

Consumers gain a holistic financial picture (i.e. banking, pensions, insurance, investments etc.) in the tools they choose; faster switching and personalised offers; safer digital journeys with verified participants and audit trails. Businesses gain streamlined onboarding, cash-flow analytics, invoice and receivables data sharing and easier access to working-capital finance. Enterprise organisations can orchestrate multi-product experiences (e.g., embedded insurance, pension dashboards and portfolio rebalancing) using consistent EU-wide access rules. These outcomes mirror those seen in markets with strong central infrastructure. For example, the UK’s Open Banking Limited framework provides transparent performance reporting and publicly tracks millions of active users; while clear standards and verification mechanisms have driven large-scale adoption in Brazil and India.).

FiDA approach in global context

The proposed FiDA regulation represents the most ambitious and comprehensive attempt globally to create a unified legal framework for open finance. While other jurisdictions have pioneered aspects of data sharing, such as the UK, Australia, Brazil and India, none have yet achieved the same cross-sector, cross-border scope envisioned by FiDA. Unlike fragmented or market-driven approaches elsewhere, FiDA seeks to embed open finance within a single legislative and supervisory architecture, harmonising data access rights, technical standards and regulatory oversight across 30 EEA jurisdictions. This positions Europe to move beyond open banking toward a trusted, competitive and privacy-preserving data economy, setting a global benchmark for how financial data can be shared securely at scale.

| Jurisdiction | Model | Scope & status | Adoptable Measures for Europe |

|---|---|---|---|

| UK (OBIE → Open Banking Limited; Smart Data roadmap) | Central implementation body + single API standard + live directory + KPI reporting | Open banking live; Government pushing Smart Data into energy, banking, finance, retail, transport, home-buying and telecommunications | Central standards, conformance testing and public KPIs accelerate adoption. |

| US (CFPB 1033) | Rights-based data access via rulemaking; private standards | Final rule issued Oct 2024; subsequent revisions underway in 2025 | Clarifying covered data and phased-in obligations ensures portability across providers. |

| Australia (CDR) | Cross-sector, statutory data right; staged rollout | Banking live; energy and non-bank lending expanding; active enforcement | Cross-sector consistency and regulator-backed accreditation/penalties build trust. |

| Brazil (Open Finance + Pix) | Central bank mandates; national standards; instant payments | 801 participants (institutions & cooperatives); 68m accounts; deep payments integration | Pairing data sharing with real-time payments drives usage. |

| India (Account Aggregators) | Licensed consent managers; public-digital-infrastructure rails | >2.2B financial accounts enabled (with 112.34m already linked); credit flow at scale | Consent orchestration + strong identity rails unlock credit for micro, small and medium enterprises (MSMEs). |

| Singapore (SGFinDex) | Government-backed, bank & agency data sharing via SingPass | Live since 2020; multi-sector aggregation | National digital identity + narrow, high-trust scope yields adoption. |

FiDA aims to blend the UK’s centralised discipline (standards, directories and KPIs) with the EU’s rights-based legal bedrock and the cross-sector ambition seen in Australia and Singapore, delivering scale across 30 EEA jurisdictions.

Design pillars for a trustworthy EU open finance ecosystem

The FiDA regulation sets the foundation and core principles for a unified and secure open finance ecosystem across Europe. Its design balances innovation with trust, ensuring consumers, businesses and financial institutions can share and access data safely and efficiently. Built on principles of transparency, interoperability and resilience, FiDA establishes consistent rules, technical standards and oversight mechanisms across all Member States, aiming to transform fragmented national approaches into a single, integrated framework for data-driven financial services.

The FiDA core principles include:

- Consent, control and purpose limitation:GDPR-aligned consent flows, revocation and clear purposes; enforced in interfaces and contracts

- Authorisation and verification by default: Machine-readable registers for data holders and FISPs; live certificate checks; audit-ready event trails

- Common technical baselines:EU-wide profile(s) for APIs, data models and performance SLAs; conformance testing and public uptime/error KPIs

- Supervisory visibility: Harmonised metrics on usage, passporting, failures and incidents to enable proactive enforcement and policy iteration

- Security and resilience:Alignment with DORA, eIDAS 2.0 and incident reporting to strengthen identity and operational controls across the ecosystem.

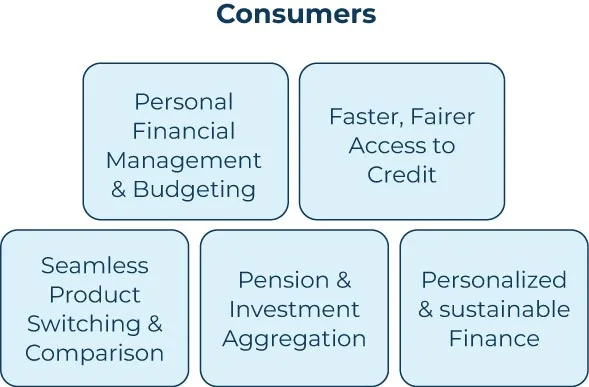

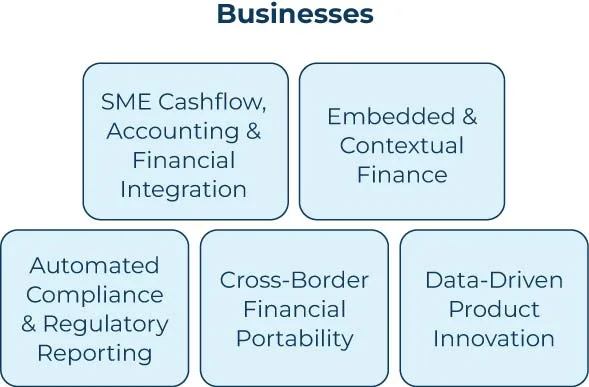

How consumers & businesses can benefit from FiDA

The introduction of FiDA will unlock a new wave of innovation across Europe’s financial ecosystem, significantly expanding the range of use cases that benefit both consumers and businesses. By enabling secure, consent-based access to a broad set of financial data, FiDA empowers organisations to develop more personalised, efficient and inclusive services. This seamless data sharing will drive competition, enhance financial decision-making and create tangible value for individuals, SMEs and enterprise institutions alike, marking a major step towards a fully connected open finance economy.

Example use cases include:

FiDA: Trilogues, outstanding issues & timeline

The draft FiDA regulation was formally published by the European Commission on June 28, 2023, as part of its digital finance package. Since then, the regulation has moved into the so-called “trilogue” phase, where the Commission, the European Parliament and the Council of the EU negotiate to reconcile their respective positions into a final regulation.

Several key issues remain under debate, including:

- Scope and data categories: There is division over how broadly data access should extend. For example, whether occupational pension rights and enriched/derived data should be covered.

- Implementation and timing: The Commission’s original draft proposed an 18-month timeframe for the establishment of Financial Data Sharing Schemes (FDSSs) and a further 6-12 months for live interfaces; however, there is now broader support for a longer and staggered roll-out with phased implementation and different data categories brought in at different times.

- Gatekeeper / big tech access: The regulation must resolve how so-called “gatekeepers” (large tech platforms) may or may not access data as authorised financial information service providers (FISPs) and how to safeguard market competition and data sovereignty.

- Cross-border passporting and enforcement: Authorisations and access rights need to operate seamlessly across Member States, enabled by supervisory authorities with sufficient data visibility and enforcement powers.

As to the expected timeline, while early commentary projected publication by the end of 2024 or early 2025, subsequent delays and the complexity of negotiations mean that agreement may not be reached before the end of 2025 and could extend into 2026.

Once Trilogue concludes and the Council and Parliament formally adopt the regulation, it will be published in the Official Journal of the European Union (OJEU). It will enter into force on the 20th day after publication, with application following the transitional period as set out in the regulation.

Based on current indications, many market participants anticipate that FiDA’s provisions will begin to apply in phases from 2027 – 2030, depending on sectoral roll-out and scheme establishment.

FiDA: Europe’s once-in-a-decade opportunity to build a coherent, secure and scalable open finance ecosystem

FiDA gives Europe a once-in-a-decade opportunity to turn fragmented data access into a coherent, secure and scalable open finance ecosystem. By aligning rights, obligations, supervision and technical baselines; and by learning from other markets, such as the UK, Australia, Brazil, India, Singapore and the evolving US rulemaking, Europe can unlock competition, innovation and consumer benefit at scale. The prize is a single market where trusted data portability is routine, cross-border services are standard practice and supervisors have real-time visibility to keep the system safe.

As Europe moves closer to agreeing the final regulation, the hard work shifts to understanding what FiDA will mean in practice for: data governance, technical standards, scheme participation, consent management and supervisory expectations. Much is still to be shaped, but the direction is clear and early preparation will be essential to realise the opportunities while managing the operational and compliance impacts.

Brendan Jones

COO Konsentus

Our team is closely engaged in the developments and would be delighted to support you in assessing readiness or shaping your strategy for the years ahead. Get in touch to find out more.